Car Shield Advice for Budget-Friendly Care

The joy of owning a car often comes with an undercurrent of financial responsibility. Between fuel, insurance, routine service, and unexpected repairs, costs can escalate quickly. Yet, with a structured plan and practical guidance, maintaining your vehicle does not need to strain your budget. A car shield plan, paired with thoughtful habits, allows drivers to manage expenses while safeguarding their investment. The following insights blend protection with practicality, offering budget-friendly care advice designed to stretch every dollar without compromising security.

Know the True Scope of Coverage

Every protection plan has boundaries. While it cushions against major mechanical failures, it does not cover every aspect of ownership. Tires, wiper blades, and other wear-and-tear components are often excluded. Understanding these limitations early forms the foundation of smart vehicle spending, because it allows you to anticipate gaps and budget accordingly. Clarity today prevents disappointment tomorrow.

Prioritize Preventive Maintenance

Repairs that arise from neglect are rarely covered. Oil changes, fluid checks, and tire rotations may seem routine, but they are your first defense against costly breakdowns. Consistent upkeep not only extends your vehicle’s life but also ensures claims are approved without issue. This is one of the most powerful forms of affordable car maintenance, because spending a small amount regularly helps avoid large, sudden expenses later.

Keep Meticulous Records

Paperwork may not feel glamorous, but it is indispensable. Service receipts, inspection reports, and maintenance logs provide the evidence providers require when processing claims. Losing these documents can lead to denial of coverage, which is the opposite of cost-effective Car Shield tips. By keeping both physical and digital copies, you create an organized archive that protects your eligibility and saves money in disputes.

Strategize Claim Filing

Not every issue warrants a claim. Minor fixes like replacing a battery or a belt may be cheaper to handle independently, keeping your coverage intact for major repairs. Filing strategically ensures you get the most out of your plan. This selective approach falls under budget-friendly care advice, maximizing value while minimizing hassle.

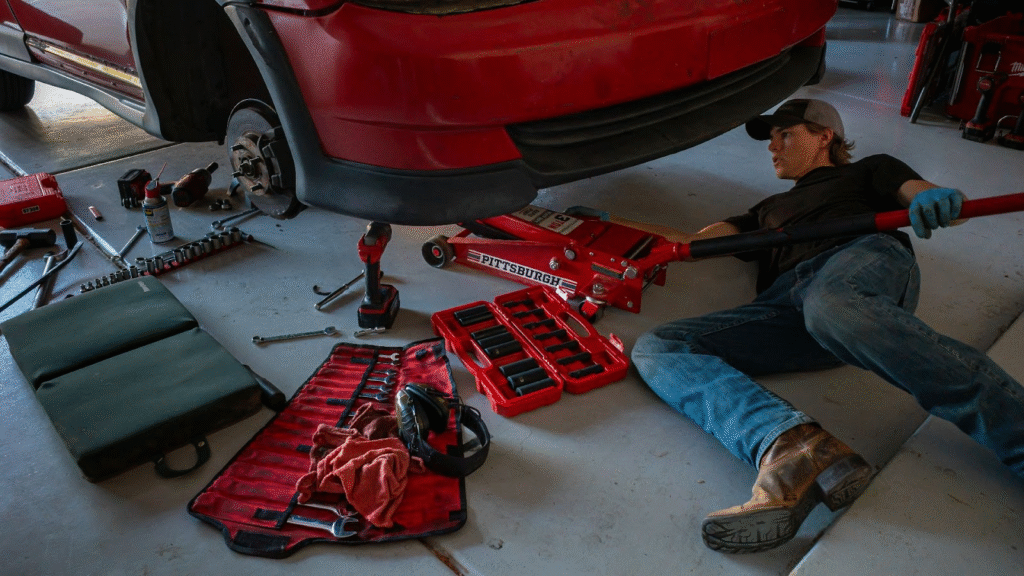

Leverage Approved Repair Facilities

Authorized mechanics are not just a requirement; they are an advantage. Certified repair facilities understand the nuances of claim approval and often have streamlined communication with providers. Repairs completed within these networks reduce the risk of extra charges and delays. Choosing them represents smart vehicle spending, as it prevents unnecessary out-of-pocket costs.

Use Technology to Track Needs

Modern cars are equipped with sensors and diagnostic systems that provide early warnings about mechanical issues. Ignoring these signals can turn manageable problems into severe breakdowns. Pairing technology with routine checks represents affordable car maintenance, because it helps you fix small concerns before they demand major intervention. Proactivity is always less expensive than reaction.

Anticipate and Budget for Exclusions

Even the best car shield plan cannot cover everything. Setting aside a small fund for items like tires or brake pads ensures that routine expenses do not catch you by surprise. This practice embodies cost-effective Car Shield tips, keeping your finances balanced while maintaining vehicle reliability. A little foresight translates into long-term stability.

Adjust Protection as the Car Ages

A vehicle’s needs change with time. A new car may require minimal coverage, while an older model may demand extensive drivetrain or transmission protection. Reviewing and tailoring your plan annually ensures your coverage remains relevant. This adaptability is one of the clearest examples of budget-friendly care advice, preventing you from overspending on unnecessary features while staying protected where it matters.

Foster Long-Term Habits of Care

Confidence on the road comes not from luck, but from preparation. Maintaining tire pressure, listening to unusual noises, and acting on dashboard alerts are simple habits that contribute to durability. Each small act contributes to affordable car maintenance, building a driving experience that is reliable, cost-effective, and worry-free.

Supplement Protection with Practical Add-ons

Sometimes an additional safeguard—like roadside assistance or rental reimbursement—creates savings in ways drivers overlook. While these may appear as extra expenses, they often offset higher costs during emergencies. Pairing them with your primary coverage reflects smart vehicle spending, ensuring you always have a fallback without draining your budget.

Caring for a vehicle does not need to become a financial burden. With careful planning, thoughtful strategy, and awareness of plan limitations, it is possible to protect your car and your wallet simultaneously. By following budget-friendly care advice, embracing affordable car maintenance, and applying cost-effective Car Shield tips, drivers can enjoy the road without the looming worry of unpredictable expenses. With smart vehicle spending at the core of your approach, every journey becomes not only safe but economically sound, blending peace of mind with financial wisdom.