[ad_1]

Automotive Month to month Newsletter and Podcast

This month’s concept: Can the vendor of currently serve the EV

purchaser of tomorrow?

The jury is no for a longer period out. Electric automobiles (EVs) are coming,

and in huge figures. We have read the message loud and very clear.

Practically each and every key automaker in the United States has declared

important investment decision commitments to changeover a significant

proportion of their product or service portfolio from interior combustion

engines (ICEs) to EVs.

- The selection of available EV products in the US is predicted to

raise 10 times above, from 26 in 2021 to 276 in 2030 - The adoption of these offerings is also anticipated to be

common - California’s share of EV gross sales in the United States is

projected to decline from 35% in 2021 to only 12% in 2030 - Tesla’s share of EV gross sales will decrease from 71% in 2021 to only

10% in 2030

To guidance this EV enlargement, governments, corporations, and EV

buyers will be essential to invest substantially to construct out

charging infrastructure, with the number of charging stations

rising from 850,000 in 2021 to nearly 12 million by 2030.

But what will this changeover imply for the typical US franchised

dealer? What variations will be required to the standard profits

course of action? Will provider income be at hazard? What investments will be

essential? The tempo of transition will differ considerably throughout

brands, but the worries and alternatives will be very similar. The

brands and dealers that can make a simplified, purchaser-centric

strategy through this changeover will create a important differentiator

all through this retail transformation.

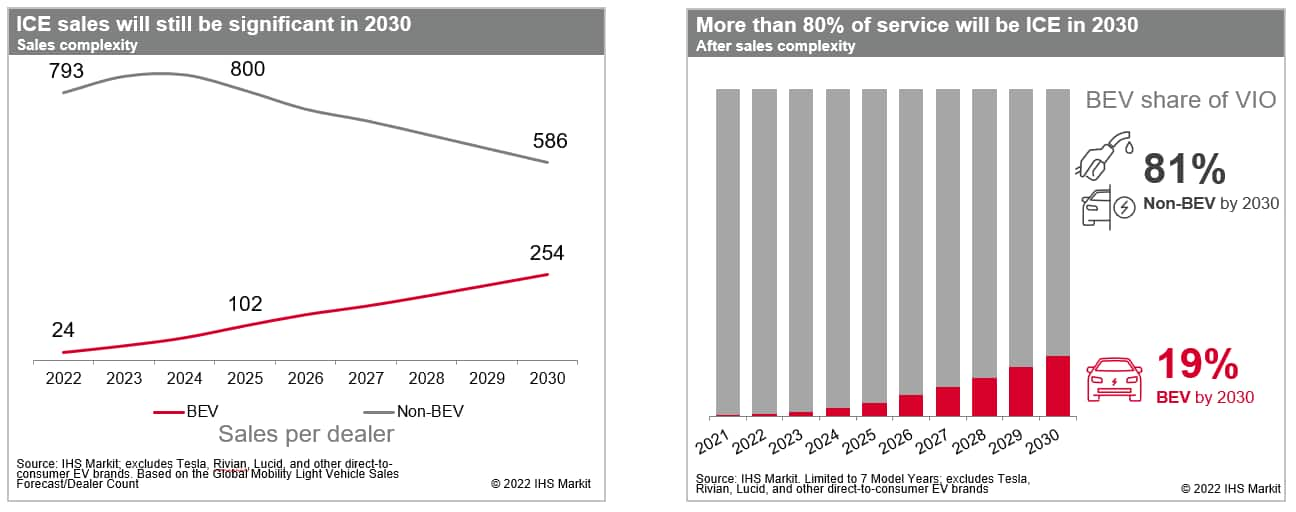

The normal franchise seller will be tasked to provide, services,

and manage relationships with a classic ICE car or truck customer

foundation, at the identical time, striving to aggressively grow the EV

small business. Even with the dramatic progress expectations for EVs, the

ordinary seller in 2030 will have a new car gross sales combine of 70% of

ICE vs. 30% EV. On the services facet, more than 80% of vehicles in

procedure (VIO) will even now be ICE automobiles. The prolonged dominance

of ICE cars will translate to hesitation from dealers to change

their substantial assets to support EV growth. Revenue manager

compensation will keep on to be dominated by selling the

regular ICE motor vehicle stock. Services lanes and workshop

processes will continue on to be organized all around ICE car or truck

maintenance and fix needs. The obstacle will be to

manage these core business enterprise operations although also laying the

groundwork for the transition to EVs and an evolving enterprise

product.

Sellers are currently being asked to make sizeable investments in

charging infrastructure as they put together for EV launches. OEMs are

creating the prescriptive needs dependent on gross sales

prospect for just about every seller. Although these investments are normally

quite huge, they are straightforward and comparatively easy to system

for. Particular EV schooling will be yet another vital spot of emphasis for

OEMs and dealer expense. Sellers could test to detect key EV

personnel as “gurus” although rising their basic dealership

expertise. This process is demanding when the the greater part of every day

business exercise will go on to target on traditional ICE

buyers. OEMs will prioritize EV training needs coinciding

with key auto launches, when also rolling out constant

discovering options. Sellers will need to have to figure out the

lengthy-expression value of these alternatives and prioritize the target

of building EV know-how throughout nearly all dealership roles. The

very best executing sellers will glimpse for speedy options to

implement this EV expertise. Quite a few buyers, even these not ready to

buy an EV, will have thoughts, supplying an opportunity to

establish EV trustworthiness within the present shopper foundation.

Being familiar with the good reasons behind an EV obtain , proactively

figuring out all those consumers, and creating qualified promoting will

accelerate the return on investment decision and create a competitive

edge in capturing EV expansion.

The transition to EVs for classic franchise dealers

introduces a sizeable complexity risk. A distracted, disjointed

company will wrestle, but a centered, harmonized company will

thrive. OEMs are conscious of the threat. Ford lately introduced its

community tactic to distinguish ICE dealers, these types of as those giving

the Ford Blue, from EV sellers, for case in point featuring the Ford Model

e, creating individual, exclusive dealer-operating standards for each individual.

Ford dealers have plainly voiced some trepidation above this

approach and there will possible be some hurdles in the execution.

Even so, it is possible we will see extra OEMs following Ford’s lead

as regular automakers try to simplify the retail technique

and contend much more successfully with EV-only brands, particularly Tesla. If

prosperous, classic automakers may locate that fully leveraging

their supplier networks will offer the aggressive edge they

have been on the lookout for to provide the EV purchaser of the future.

———————————————————–

Dive Further:

View our webinar replay on

EV Charging Deserts: The place should we develop an

oasis?

Download our Automotive

Credit Investing Whitepaper

Inquire the Skilled a Question –

Kristen Balasia

Check with the Skilled a Concern – Treffen

White

Subscribe to our month to month Fuel for

Imagined newsletter & podcast to keep connected with the most up-to-date

automotive perception

This report was revealed by S&P Worldwide Mobility and not by S&P International Rankings, which is a separately managed division of S&P World-wide.

[ad_2]

Resource hyperlink