[ad_1]

Mainland Chinese medium- and heavy-duty trucks (MHDTs) have

entered a bear marketplace considering that mid-2021. Though the market staged a

slight recovery adhering to the easing of electrical power shortages and

injection of plan stimulus from late final 12 months, sudden

headwinds introduced by the Russia-Ukraine crisis and domestic Omicron

outbreak plunged the marketplace back into weak spot in the next

quarter of 2022. Amid pandemic-induced lockdowns in Jilin and

Shanghai, creation of MHDT hit the lowest looking at for April more than

a 10 years. In our May forecast, we downgraded the mainland Chinese

MHDT generation for 2022 by 5% to 1.13 million units, a decrease of

23% compared with 2021.

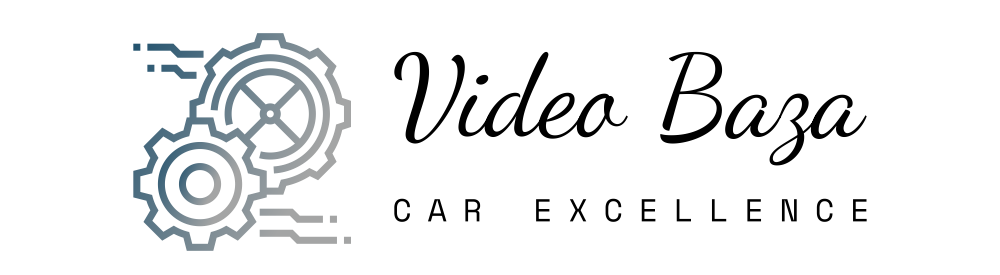

External geopolitical tensions drive up producer prices

As uncooked components symbolize 20-30% of the expense of manufacturing for

weighty trucks, uncooked material costs partially establish the

profitability of truck producers. Owing to the worldwide financial

restoration from the COVID-19 scare, commodity selling prices have

undergone an upcycle due to the fact late 2020. The rally gained additional steam

in the 1st quarter of 2022 with the outbreak of the

Russia-Ukraine war. Precisely, the cold-rolled steel price that

accounts for more than 60% of the total uncooked substance expenses for a hefty

truck surged by 3% in March 2022 from the degree of January,

growing the growth to more than 40% as compared to the identical

period of 2020. Also, the diesel price tag lifted by 15% and handed the

RMB9,000 for every metric ton mark by means of January-March 2022. In

contrast, the movement of offering charges for significant vehicles had been

rather flat under slack need, as fuel value inflation elevated

the functioning prices when oversupplied trucking constrained freight

rate progress. As a end result, the truck producers’ buying and

providing charges logged sizeable differentiation, regardless of an

enhance in selling price of CN6-level versions. This kind of weak inflation

move-by influence has created truck makers to bear the brunt of the

income margin squeeze primarily just after dumping of CN5-level trucks.

With the Russia-Ukraine crisis anticipated to deepen into 2023,

short-expression truck manufacturing is thus slice by all-around 25,000 units

in the May possibly outlook.

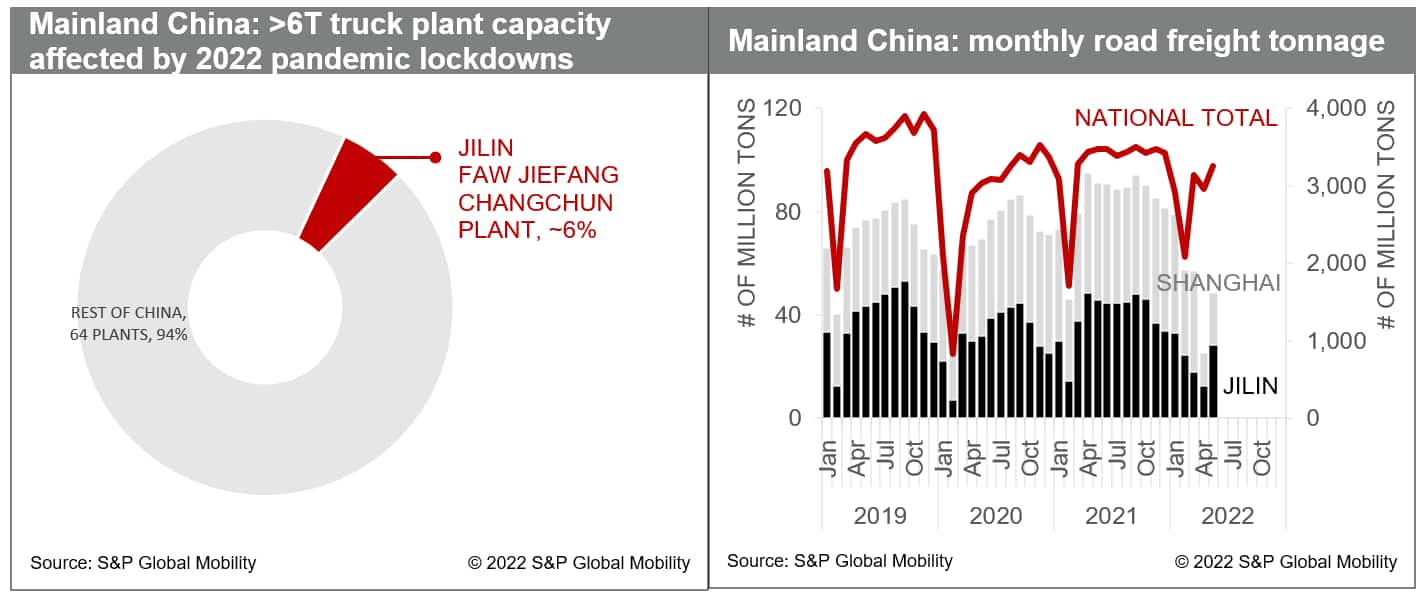

Inner pandemic resurgences exacerbate provide chain

disruptions

The Omicron wave had activated significant lockdowns in Jilin

Province (March 11-April 28), Shenzhen Metropolis (March 14-20), and

Shanghai Metropolis (March 28-Could 31) because March 2022, ensuing in

widespread enterprise disruptions and logistics snarls. Even though

there are several MHDT companies in the epicenters of the pandemic,

Changchun City and Shanghai Metropolis host around 40 major source bases

serving core factors to mainstream designs covering higher than 90% of

truck creation. Setting up from mid-April, FAW Jiefang’s Changchun

plant and most suppliers managed to resume operate in the closed-loop

program, but labor shortages under the mobility command disabled

them to purpose at usual capability. In the meantime, rigorous

containment steps this kind of as website traffic limitations, nucleic acid

exam and quarantine necessities, as nicely as closure of toll

stations pent up highway freight need and triggered wider repercussions

of ingredient shortages, which in transform dampening truck generation.

Below the conditions, the complete reduction of MHDT generation in the

next quarter is approximated to access 100,000 units. With ramping up

endeavours to smooth logistics and restore company, the get the job done

resumption rate of enterprises over selected dimensions in Shanghai

Town enhanced to 96% by mid-June and will fully get better from July.

Coupled with expansionary policies and enough capability

reserves, these could assist MHDT manufacturing to pick up and offset

the pandemic-induced reduction in the second 50 percent.

A more downgrade to outlook is underneath evaluation, as the

government’s reliance on the “dynamic zero-COVID” tactic and

money outflows led by the Fed’s tightened cycle are likely to

weaken business enterprise sentiment and subdue demand restoration. On the other

hand, the rebuilding of dealer inventories of CN6-stage MHDTs

climbed from 280,000 units in early this 12 months to 380,000 models by

April, way larger than the common premiums of 150,000-170,000 units.

Additionally, there had been additional than 70,000 units CN5-stage new

trucks (bought as utilized trucks) remaining in the current market, exacerbating

de-stocking pressures.

This write-up was printed by S&P Worldwide Mobility and not by S&P International Ratings, which is a independently managed division of S&P World wide.

[ad_2]

Supply backlink